With crowds finally returning to stadiums, excitement is building ahead of the start of this year’s Six Nations rugby tournament this weekend.

As defending champions, all eyes will be on whether Wales can maintain the form that saw them triumph at last year’s tournament. Or will a resurgent Ireland, a bruised England, and a maturing Scotland dethrone the red dragon? Can France put in a consistent challenge? Can Italy ruffle a few feathers?

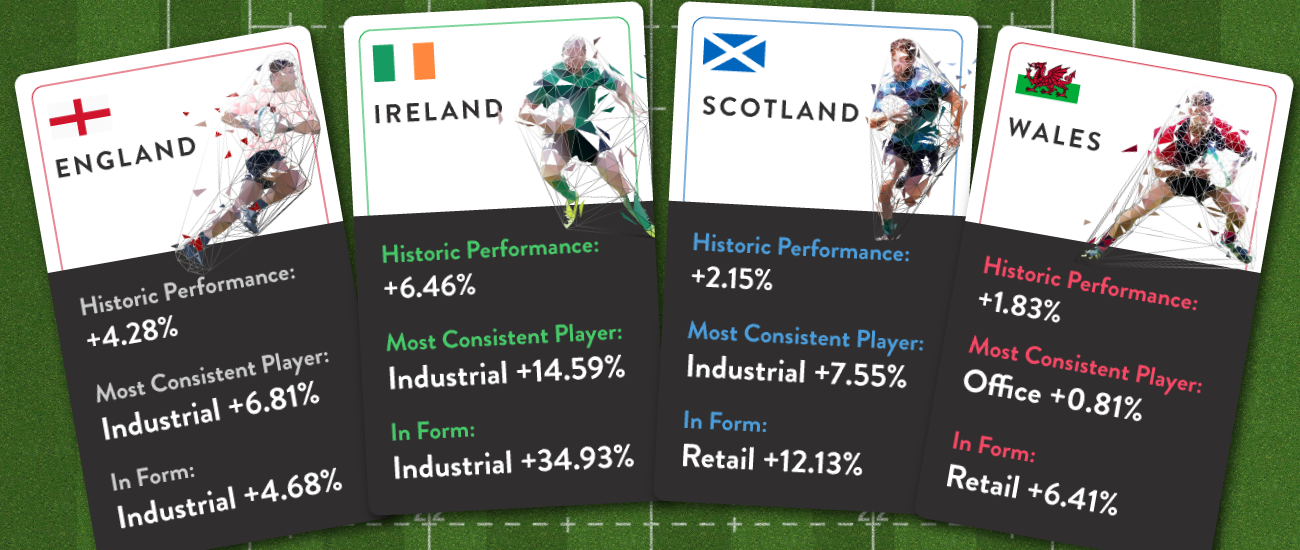

With the teams preparing to do battle on the pitch, off the pitch, commercial real estate platform Coyote Software looks at the recent form of England, Scotland, Wales and Ireland, when it comes to the commercial rental market.

Collating data from 19,663 leases across the office, retail and industrial sectors, Coyote gives the lowdown on who’s performing well, which sectors are ever dependable, which are in form and which are out of form.

Oli Farago, CEO of Coyote Software, comments:

“It was a tough year for all the teams in last year’s Six Nations, playing in empty stadiums and managing Covid restrictions. Off the pitch, it was a similarly challenging couple of years for the commercial rental market, but as we emerge from the pandemic there are signs that the home nations and Ireland are bouncing back. The industrial sector has been a consistent performer across the board for the past five years and continues to lead the pack in England and Ireland more recently, whilst retail is the in-form player in Scotland and Wales.

As 2022 unfolds, what’s absolutely critical is access to live, accurate and detailed information. In a fast-changing market, investors and asset managers need to know not just how whole sectors and regions are performing, but how individual portfolios and assets are performing week-to-week. Only data can provide the level of insight needed to make truly informed decisions.

Historic performance

(Growth – past 5 years)

Ireland*: +6.46%

England: +4.28%

Scotland: +2.15%

Wales: +1.83%

Recent form

(Growth – 2020-2021)

England: +4.1%

Wales: -6.63%

Ireland*: -7.45%

Scotland: -15.29%

Most consistent player

(Sub-sector Growth – past 5 years)

Ireland: Industrials +14.59%

Scotland: Industrials +7.55%

England: Industrials +6.81%

Wales: Offices +0.81%

In form

(Sub-sector best YOY Growth 2019-2021)

Ireland: Industrials +34.93%

Scotland: Retail +12.13%

Wales: Retail +6.41%

England: Industrials +4.68%

Out of form

(Sub-sector weakest YOY Growth 2019-2021)

Scotland: Office +0.96%

Wales: Industrials +0.22%

England: Retail -0.98%

Ireland: Retail -14.07%

* Ireland includes NI + RO

This article originally appeared on Property Week on 3rd February