M7 Real Estate has won the mandate to manage Alternative Income REIT

The listed-vehicle, which has a 19-asset portfolio valued at £108.8m as of 31 March, was previously known as AEW UK Long Lease REIT.

The company had been without an investment manager since 9 April when a contract with AEW was terminated.

The board of the company said that it believes the appointment of M7 “will improve the company’s performance and enhance the appeal of the company over a long term” and that with “the expertise and resources provided by M7, the aim is to achieve a narrowing of the company’s discount and, in time, attract new investors”.

M7 will provide advice, support and services including strategy, debt advisory, reporting, fund accounting and investment advisory services together with asset management, operational advice, budgeting and planning for the portfolio.

A track record of returns

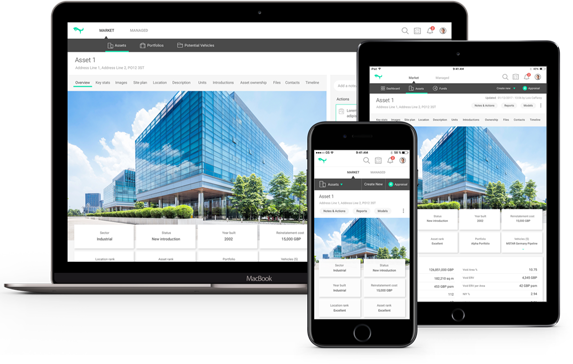

The company cited M7’s track record on achieving returns of above 25% on all of the UK mandates it has managed since launch in 2009 and the use of its information and data management system Coyote as factors in its decision.

An initial agreement has been put in place until 31 March next year during which time M7 will undertake a review of the company’s assets, investment policies and restrictions with the view of entering into a subsequent longer-term management agreement.

M7 will be paid a fee of 0.5% of the company’s net asset value quarterly in advance, subject to a minimum fee of £90,000 per quarter from 1 October 2020.

Last year the board, led by chairman Steve Smith, conducted a strategic review of as it felt that the company was sub-scale. On 25 February it appointment a raft of service providers, including Mason Owen as investment adviser and property manager, and on 3 April the company changed its name to Alternative Income REIT.

When the company was floated in 2017 it raised just £80.5m of its £150m target, amidst a raft of managers all looking to launch similar long-lease vehicles over the same few months.

Steve Smith, chairman of Alternative Income REIT, said: “The board welcomes the appointment of M7 who will work with the group’s recently appointment service providers to achieve best value for our shareholders. We look forward to working closely with such an experienced and well-resourced team with an excellent track record of delivering strong returns to investors. We expect to extend M7’s contract in the spring of next year if not before.”

Richard Croft, chairman of M7 Real Estate added: “To be appointed by the board of Alternative Income REIT is a hugely positive endorsement of the M7 Real Estate platform, allowing us to utilise not only our core asset management skills, where we have a strong record of value creation, but also our wider strategic investment, fund and debt advisory expertise. We now look forward to focusing these services on the company and its portfolio in order to create value for its shareholders.”

This article originally appeared on React News on Monday 18th May 2020.